Corporate Governance Demystified

February, 2021

LETTER TO A CHAIRPERSON

M. Damodaran

Chairperson, Excellence Enablers

Former Chairman, SEBI, UTI and IDBI

It is not usual for a small shareholder to write to the Chairperson, especially when she/he has no personal grievances. It does not mean that there are no doubts or reservations in the minds of shareholders. In this issue, we take a look at some of the many issues that have occupied mindspace and need to find expression.

Dear Chairperson,

You might not know me or recognise me. That is not important. I am a small shareholder in your, sorry, our Company.

For many years, come rain or shine, I have turned up at the Annual General Meetings (AGMs). They were like meetings of a very large extended unplanned family, with a number of persons having only one common qualification, that of being a shareholder in the Company that we are proud to be a part of. Over the years, I, as well as a number of persons of similar vintage, have warmly greeted one another, without knowing the person or his/her name, since this was the only occasion in the year when we got together.

I have been thinking of writing this letter for quite some time, but have held back knowing your busy schedule, and having regard to my reluctance to impose myself on you. Now this letter cannot be postponed, since the Government has declared that companies can hold their AGMs/ EGMs (Extraordinary General Meetings) by virtual means till the end of 2021. To make matters worse, there was a news item saying that hereafter, companies would hold their AGMs only by virtual means. While I hope that is incorrect, I apprehend that might be the case since the media often guess correctly what is in the minds of the decision-makers.

I have no complaints about the operations or the performance of the Company. You have been giving us dividends year after year, and the share price of the Company has gone up significantly. But virtual meetings have knocked the fun out of our existence as shareholders. The excitement of thanking you for a good dividend, and in the same breath, asking for more, has gone away. Even as we asked for higher dividends, some of us wondered why as a major shareholder, you did not see things our way, since you would have stood to benefit the most from a higher dividend.

We have also changed significantly. No longer do we complain about the refreshments served at the AGM, or the relative difficulty in accessing water bottles, while all of you on the stage seem to be having steady refills or replacements.

In some of the AGMs that I have attended in the past, the Managing Director (MD) or the Chief Executive Officer (CEO) made a detailed presentation on where the Company is, and where the Company expects to be going forward. Now, far from presentations, we have to be satisfied with the presence of the MD or the CEO at the AGM.

Part of the excitement of the AGM was to see all the persons at the highest level of decision-making in our Company turning out in formal attire, and smiling at us from the stage. From where you were seated, you could not have seen this. The smiles got bigger, and stayed longer, especially, if a Director was coming up for re-election. As for the others whose terms would continue beyond this meeting, some of them were busy with their mobiles, while making unsuccessful bids to hide the object of their interest. A physical AGM gave us the opportunity to identify those that were only physically present, and those that were involved in the proceedings.

One relatively recent stipulation by the Government of India has got me all confused. I am told that Independent Directors (IDs), barring some exceptions, will have to take a qualifying examination to remain as IDs. I do not know how many of the venerable women and men, that I have seen on the stage, have taken the exam, and have qualified. I also wonder whether passing an examination will make someone a better Director, who will, in the boardroom, look after the interests of persons like me. Specifically, I would like to be enlightened on whether empathy for the common man can be determined by a written examination.

We have been given to believe that one of the major responsibilities of an ID is to look after the interest of minority shareholders. In a recent case that the press reported, a veteran ID, with 9 months left in the present term, chose to walk away on the ground that more time needed to be devoted to personal matters. If such a claim is made by one of our Directors, I expect you would persuade him/her to complete his/her term, and leave. A premature departure gives rise to all manner of conjecture, and that is not good for any company. I also understand that at the same time, there are thousands of persons willing to get into boardrooms, fully conscious of the liabilities. I wonder what the risk-reward trade-off is for them, especially in financial institutions.

We also miss the sometimes extravagant praise heaped on the Company Secretary for ensuring that the documents pertaining to the meeting reached us on time. We conveniently forgot that that was part of his/her job description, and were intolerant of the handful of persons who complained about non-receipt of the documents.

While going through the Annual Report, I discovered that all the complaints that had been received during the year, and were pending at the commencement of the year, had been disposed of. I remember that a few years ago, I had sent a complaint to the Secretariat department, and had received no response. I sent a couple of reminders, and then I enquired, during one such AGM, with the Company Secretary how my complaints had been disposed of, since nothing was shown as pending. I was told that what I had referred to as a complaint, was not the kind of grievance captured in the statement. As for my reminders, I was told that they had no earthly chance of qualifying as a complaint. Having brought this to your notice, I am prepared to live with the non-disposal. What worries me more is whether the other numbers in the Annual Report will stand up to similar scrutiny by better informed shareholders.

I occasionally read in the newspaper that in some company, some person described as an insider, is punished for receiving and/or acting on information that the likes of me did not get. I know that ours is a Company that would have all the checks and balances in place, to prevent occurrences of this kind. I would like to be assured that my comfort is well founded.

The last year has been a difficult one for all of us. I know that a very large portion of our workforce has had to work from their homes. While, on the surface, this would have seemed like a blessing, especially in the short-term, because of not having to travel long distances, an element of boredom must have crept in by now. Many of them must be missing the opportunity of interacting with their colleagues, just as I miss the opportunity of being with fellow shareholders once a year. I am told that family members of the employees, while being excited initially with their presence, are wondering when work-from-home will come to an end because they could regain the physical and mental space that they had ceded. I also know that ours is one of the companies that did not take advantage of Covid to send people home, and to keep them there forever without jobs. I hear you say on every occasion that these are competitive times, and we must reengineer the Company to meet present and future needs. Will this translate to right-sizing the workforce, as companies have chosen to describe the unfortunate exercise of sending people home forever? I understand that the variable element of the pay could have been reduced. After all, a person is paid for work done, and not for holding a position. Ours is after all a private sector Company.

I also read that a number of small companies have shut shop for a variety of reasons, including, but not limited to, not being paid by larger entities to whom they provided goods and services. I do hope that our Company, with its heart in the right place, has not done anything of this kind.

There was a time when people like me, on receiving the Annual Report, opened the page containing the auditor’s report first, much like the cricket fan, in recent times, would have opened the sports page first on receiving the newspaper. If the auditor indicated satisfaction with the financial statements, the rest of the report would have been of academic interest for many shareholders. Persons like me are aware that before an auditor says that things have passed muster, he/she would have put in several disclaimers as appropriate exit lines, if something went wrong. Now I read of regulatory authorities coming to the conclusion that some auditors failed the tests of professionalism and independence. Please advise me whether I should continue to treat the auditor’s report as gospel truth.

I know that Regulators are not within the purview of our Company. Yet as an insignificant presence in the ecosystem, I have to turn to you to mention that I am unable to understand the thinking of some of our Regulators. I often wonder whether regulations are the means or the end. All along, I was of the view that they existed to ensure a level smooth playing field for persons in business. Now, with every additional regulation, I am beginning to wonder what happened to the objective of promoting the ease of doing business.

A related concern is that when the first-level Regulator comes to a finding, it is more often than not, turned down by the appellate authority, whose orders are, then in many cases, set aside by the highest Court. I cannot imagine how business is conducted when there is lack of clarity on the impact of law and regulations. Sometimes I feel that persons like you should be given bravery awards for having courage to stay on in business.

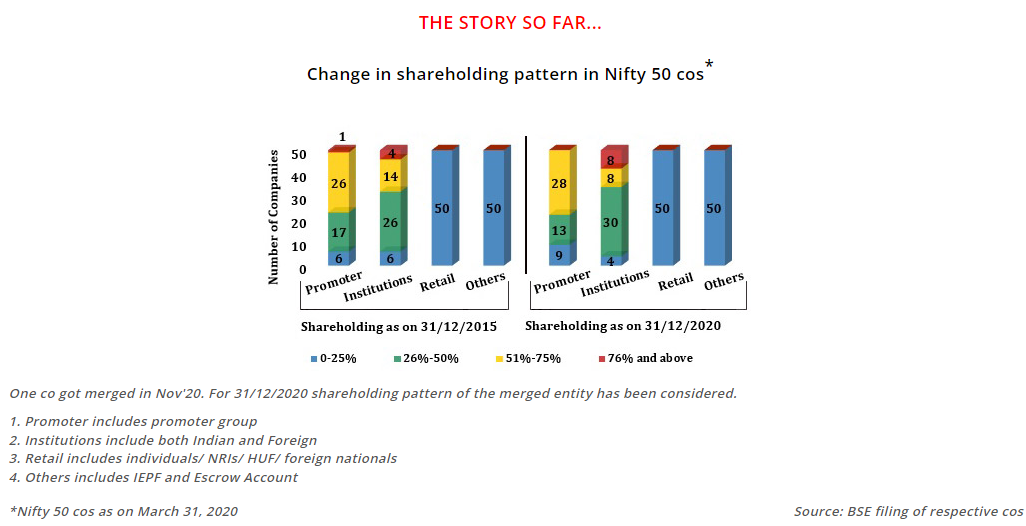

We are told that we live in a disclosure-based regime, and yet, when the Stock Exchanges ask for clarification on news items, the response is often evasive. Don’t you think that companies should disclose more, and disclose better, so that small shareholders like me do not feel relatively deprived, as compared to institutional investors for whom this is their day job?

We have a number of investor associations in different parts of the country. We meet often, and share our grievances and concerns in the hope that they will reach the right persons for redressal. I know for a fact that some of them write to the companies concerned and to the Regulator, seeking action in regard to our complaints and suggestions. Do you think it will be a good idea for companies to proactively reach out to investor associations? Could that be one of the reasons why the erstwhile Shareholders Grievance Committee was renamed Stakeholders RELATIONSHIP Committee?

Even as I was about to sign off on this letter, I saw that our share price had gone up significantly in the first few hours of trading. I also hear that the stock market is a bubble that is about to burst. Please reassure me that bubbles are what cricketers live in during tours in Covid times, and that our Company is not living in a bubble.

Yours sincerely,

ABC

Retail shareholder

READERSPEAK – THE YEAR THAT NEED NOT HAVE BEEN

Vinita Bali, ID on listed entities and Former MD, Britannia Industries

“I am less optimistic about the bounce back as the economic and social health of India is not reflected in the stock market but in the everyday lives of everyday people for whom a decent life is a struggle.”

BVN Rao, Business Chairman, Transportation, and Urban Infra, GMR Group

“I understand that the pattern for examination of Independent Directors is not very relevant and does not enhance the Boardroom requirements and needs major revamp. Hope with adequate interventions from intelligentsia, there could be changes soon.”

Aniruddha Ganguly, Founder, EU Matter Consulting and Former ED, Group Corporate Development, GMR Group

“Most of the governance issues lose far-sighted objective treatment due to numerous government / political interest groups raising a cacophony. Keeping things simple is perhaps the most complex task.”

Do let us know of any specific issues you would like to see addressed in subsequent issues.

Excellence Enablers

Corporate Governance Specialists | Adding value, not ticking boxes | www.excellenceenablers.com

(292KB)

(292KB)