- Home »

- August 2022 »

EXPERT EXPRESSIONS

Corporate Governance Demystified

August, 2022

DO GOOD AND FEEL GOOD

M. Damodaran

Chairperson, Excellence Enablers

Former Chairman, SEBI, UTI and IDBI

No bigger truth was spoken than the profound observation of a far-sighted person, years ago: “We have not inherited the Earth from our parents. We have borrowed it from our children.”

The long journey towards responsible corporate citizenship has seen many twists and turns. To begin with, there was extensive discussion and debate on whether corporates were expected to look after the interests of only shareholders, or whether there was a wider constituency outside that also needed to have its interests taken note of, and addressed. Milton Friedman of the Chicago School was the high priest of the philosophy which advocated that only shareholders needed to be taken care of. This limited perspective yielded ground over time, and today, across geographies and jurisdictions, it has been accepted that the interests of all stakeholders need to be kept in mind by corporate entities.

This expectation has not automatically translated to understanding the needs of other stakeholders, and capturing them in the decision-making process. The limited initial efforts confined themselves to redressing grievances that were brought to the notice of the corporates, but did not extend to proactively identifying stakeholder needs, and moving in the direction of putting in place the right practices.

In India, the journey has been on predictable lines. Following the coming into effect of the Cadbury Committee on Corporate Governance, India too saw several committees being set up, with several recommendations emanating from their reports, as to the steps to be taken to improve Corporate Governance. The G pillar in ESG (Environmental, Social and Governance) has been the subject matter of discussion and debate for far more than the E and S pillars have been. The recognition that society as a stakeholder was an important constituent that the corporates need to engage with productively, had a later origin. Long before laws and regulations provided for Corporate Social Responsibility, Jamshetji Tata had captured the spirit of this intervention by providing for the sustainable development of Jamshedpur city and its neighbourhood. Without any law or regulation pointing in that direction, an impact assessment of various initiatives was undertaken in Jamshedpur.

Early moves towards nudging corporates in the direction of responsible citizenship took the form of voluntary guidelines, which enumerated the positive aspects of what corporates needed to do to address stakeholder interests. The Companies Act, 2013, for the first time, provided that 2% of the average net profits for the previous 3 years, should be spent on schemes and programmes, as also thrust areas, that would benefit the community. In the only instance of its kind in the statute, the “comply or explain” principle from the United Kingdom was imported. Over the years, “comply or explain” has moved towards “comply”, with, no excuses, masquerading as explanations, being acceptable. Doing good changed from being an affair of the heart being in the right place, to a set of accounting entries.

Acts of God, and Acts of State, often prompt Governments and other authorities to take contextually correct decisions. Covid-19, and its devastating effect on the workforce, forced corporates to take a close and hard look at the needs of the workforce in the parent companies, and in some cases, in the associate and subsidiary companies, as also the entities in the supply chain. Physical and mental health became areas that companies increasingly focused on, and to good effect. For the first time, Covid-19, an Act of God (unless one wants to credit the Chinese with this development) brought increasing focus on the S pillar of ESG.

The E pillar of ESG, representing the environment, was for long, the subject of animated conversations, without corresponding conviction or corporate commitment. Some perfunctory steps, representing low hanging fruit, were touted by corporates as major accomplishments in the environment space. There was recognition that the present generation owed it to the subsequent generations to leave the planet in at least as good a condition as they found it. However, mindless industrial expansion, leading to adverse impact on the environment, took their toll in most geographies. This led to calls for conservation of water, reduction in carbon footprint, replacement of fossil fuels with renewable energy sources, and the like. The Business Responsibility Report (BRR) which was SEBI’s first initiative in this space, pointed corporates in the direction of reporting on what they had been doing to conduct business responsibly. It also served the purpose of holding a mirror to the corporates on what they had not been doing, and should commence doing, within a short while. The lack of adequate quantification was a major setback, and creative corporates used language to cover up for non-performance. The Business Responsibility and Sustainability Reporting (BRSR), which has been introduced, and will take effect in the current year, is a significant improvement, not merely because it is more comprehensive, but also because it calls for a higher degree of quantification of achievements in regard to most parameters. Significantly, it introduces “sustainability” as an element which needs to be centre stage in all that corporates do in this sphere.

With ESG now occupying significant mindspace, and being projected as the one comprehensive element which would set apart good corporates from bad corporates, there has been the expected pushback from some quarters. It takes one back to the time when Corporate Governance was initially being actively canvassed. Many persons, academics included, argued that Corporate Governance did not add to the strength or the performance of any company. In fact, some of them went to the extent of calling it an avoidable distraction, which could deflect managements from the straight and narrow path of profit maximation and enhancement of market share. It took several Corporate Governance failures across jurisdictions, for the acceptance of the fact that, other things remaining the same, a well governed company would be better off in the long run. The concept of “governance premium” gained ground slowly, but surely.

Fast forward to present times, and we have critics saying that ESG is a fad that will deliver no value. One distinguished economist of global renown has described it as a “feel good scam”. Only time will tell whether such descriptions are themselves sustainable. The argument that investments premised on ESG will over time deliver comparatively suboptimal returns is neither here nor there. There ought to be a balance between doing good for society and doing good to shareholders. Leaving society out of corporate consideration is almost certain to be the last nail on the coffin of sustainability.

Comrade Putin’s adventures (or misadventures, depending on which side of the political divide one is) have administered a significant body blow to the E element of ESG. European nations, which were in the forefront of the campaign for stepping up ESG practices, have now, in acts of self-preservation, gone back in a big way to fossil fuels to address present needs, ignoring the impact on the future. This too has prompted the naysayers to pronounce that the “ESG fad”, as they describe it, will disappear even before Putin makes his last moves on the political chessboard. If Covid-19 was an Act of God that prompted focus on the S pillar of ESG, the Act of the Russian State has had the consequence (hopefully unintended) of detracting from efforts relating to the E pillar of ESG.

What should Indian corporates do? The BRSR which comes into being this year, is, all things considered, a report. It is important for corporates to take necessary steps that will help to populate the report in a positive and a productive manner. The application of western standards, principles and parameters, in mindless fashion, could be problematic. It is necessary to ensure that there is no disconnect between Indian ground realities and the ESG framework that Indian corporates are tasked to conform to. More than ever before, there is the need to capture what is relevant to Indian conditions, without legitimising the irregular practices that have added up to some of Indian reality. Looking at the needs of various stakeholders through an Indian lens, and putting in place the relevant parameters under each of the 3 pillars E, S and G, would be a step in the right direction.

To ensure that corporates are moving in the right direction, and at the right pace, the Board needs to ask a few questions. Firstly, what steps have been taken, or are proposed to be taken, to help with the preservation of the planet? Secondly, have the efforts remained confined to making financial provisions, without thinking through the manner of implementation? Thirdly, having started on some ESG initiatives, has any impact analysis been undertaken to decide whether any changes are needed in programme content or in the manner of implementation? Fourthly, is the company’s workforce involved in these initiatives? Involvement should be more than merely volunteering for identified activities, and should extend to generation of relevant ideas and suggestions. Finally, since corporates implement some of these programmes through implementation partners, are these partners spending the funds in a manner consistent with the objectives of this initiative?

If we are to leave the planet in at least as good a condition as which we found it, ESG, notwithstanding its initial shortcomings in practice, needs to be kept centrestage of the corporate thought process. The equivalent of the Regulatory Impact Assessment should be considered. Every action that goes into the productive process should be preceded with the question on what harm, if any, it could cause to the environment. This is, without argument, a herculean challenge. It is time for corporates to recognise that the road towards good corporate citizenship is not a path of roses. However, the rewards of travelling on the thorny path, and doing good deeds on the way, can be more rewarding than most entries in the financial statements. The way to Hell may be paved with good intentions. Equally, if not more, the way to Heaven could be paved with good intentions given effect to by good practices, founded on good principles.

THE STORY SO FAR…

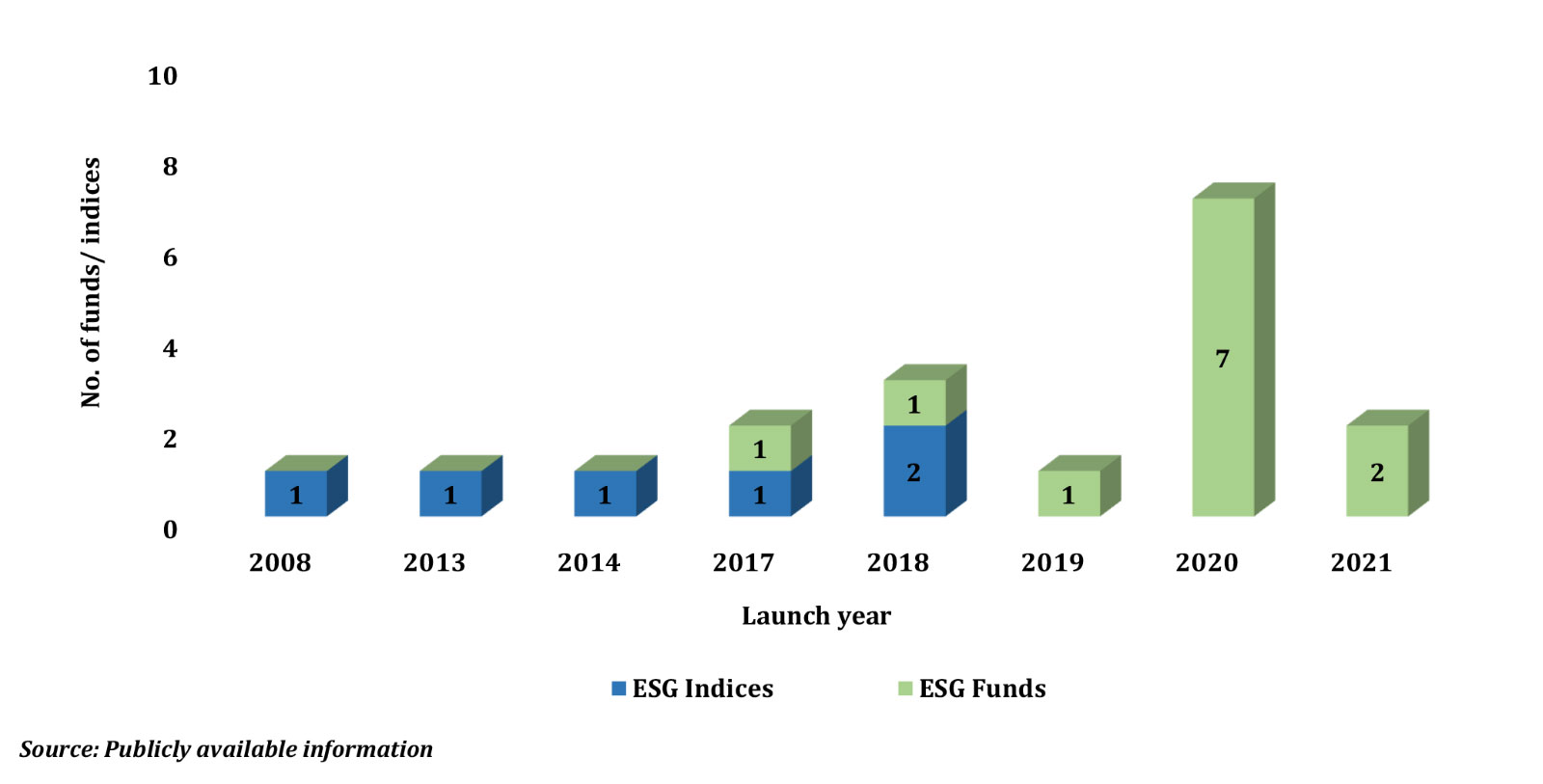

ESG Funds and ESG Indices in India

Excellence Enablers

Corporate Governance Specialists | Adding value, not ticking boxes | www.excellenceenablers.com

(292KB)

(292KB)