Corporate Governance Demystified

August, 2021

IN SEARCH OF INDEPENDENCE

M. Damodaran

Chairperson, Excellence Enablers

Former Chairman, SEBI, UTI and IDBI

Boards that seek to challenge management, must act independently. Is regulation the magic potion to foster independence?

In the winter of his discontent, Alan Greenspan, the long-serving Chair of the US Fed, made a profound statement. “You cannot legislate for honesty” he said. It is perhaps time to take a leaf out of his book, and to recognise that one cannot legislate for independence of mind.

In the course of the last one year, SEBI’s leadership is understood to have lost a lot of sleep trying to work out how to make Independent Directors (IDs) more independent than they presently are. Independence as an attribute, is a binary proposition. One is either independent or one is not. Therefore, to tweak regulations in search of higher levels of independence would be nothing more than attempting a solution, without a proper diagnosis of the problem.

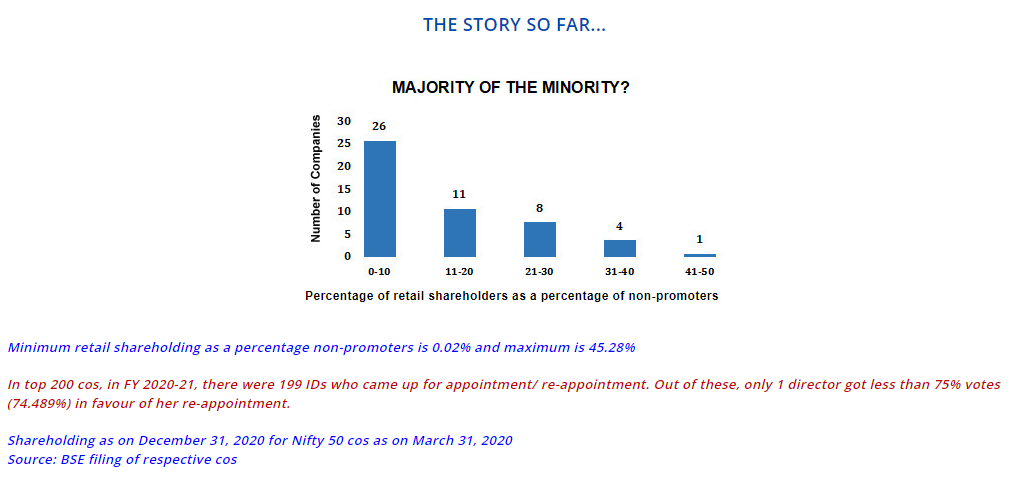

SEBI’s Consultation Paper, which was put out in the month of March, 2021, envisaged a two-stage approval process for appointment of IDs. The first stage was a continuation of the existing provision that a resolution for appointment of an individual as ID should be passed with the support of a majority of the shareholders. Further, in reinforcement of the mistaken notion that IDs exist on Boards only to protect the interests of minority shareholders, SEBI proposed a second stage of approval, which contemplated that a majority of the minority shareholders should also vote in favour of the appointment of the concerned individual. The proposal went on to state that where the candidature of an individual does not meet with the approval of the majority of the minority, the company could again take the proposal to the shareholders, and seek approval by a simple majority.

During the process of consultation, several issues involved in this two-stage process must have surfaced. Firstly, a two-stage process is administratively cumbersome, and needlessly adds to costs. Secondly, the idea that in the event of the majority of minority voting against the resolution, it was open to the company to go back to the shareholders, is disrespectful to a minority that has already indicated its thinking on the subject. It is also highly unlikely that a self-respecting prospective ID would offer his/her candidature a second time after being rejected the first time.

The final regulations, which have been approved, and are expected to come into effect on January 1, 2022, have combined the two-stage process into one, and provided that a special resolution will be necessary in the case of every fresh appointment. As of now, a special resolution is required only for a re-appointment of a Director or for the appointment of a person who is the above the age of 75. This is understood to be an attempt to factor in the voice of the “majority of the minority”. The disconnect with contemporary reality is very obvious when a study is undertaken of the percentage of shareholders who have voted in support of resolutions for appointment of IDs. In most cases, such resolutions pass with more than 90% support, and in quite a few cases, it is as high as 98-99%. Clearly therefore, minority shareholders have so far not demonstrated unhappiness with the candidates whose appointments have been proposed. It follows that what is now sought to be implemented is a solution for a problem that does not exist.

It is also necessary to understand who these minority shareholders are. In uninformed conversation, there is a tendency to equate minority shareholders with retail shareholders. If the intention is that the proposal would benefit retail shareholders, a perusal of the shareholding pattern of many of the large companies will help to dispel the myth. Institutional investors, both foreign and Indian, constitute, in almost all companies, a large majority of the minority shareholders. Any attempt to empower minority shareholders will result in empowering institutional shareholders. It is not clear whether this is the unstated objective. The shareholding pattern of most companies will ensure that institutional investors will be able to checkmate the management in the appointment of IDs with whose track records they might be unfamiliar. What is worse, institutional biases and prejudices could impact on the voting pattern.

There is yet another element which should not be lost sight of. Most institutional investors act on the advice of the proxy advisory firms when it comes to supporting or opposing resolutions. Resultantly, any attempt to empower the minority shareholders will, at the first level, amount to empowering institutional shareholders, and at one remove, the handful of proxy advisory firms. How such a scenario will square with the preamble of the SEBI Act, which places the investors centre-stage, is a matter that merits contemplation.

There are some IDs who are truly independent, and some who are not independent. The first category does not require regulatory empowerment, and the second category will be impervious to regulatory encouragement.

Business in India is carried out in an atmosphere of deep distrust. For several decades, businessmen have not been trusted to act in a bona fide manner. In the name of checks and balances, several institutional arrangements, such as an appropriately constituted Audit Committee, and an entity called IDs, have come into being. Over time, the distrust would appear to have been transferred from the businessmen to the IDs, with the default option being that the IDs will not act independently, especially when the interests of the majority shareholders are involved.

It is a sobering thought that in India’s seventy-fifth year of independence, we continue to believe that there is no independence in India’s boardrooms.

Parallelly, the exercise of identifying skillsets required in Directors, and getting Directors certified through an examination that seeks to test knowledge, continues unabated. What is clearly missing is the recognition that boardrooms require behavioural attributes, rather than an understanding of legal and regulatory provisions.

Desperate situations call for desperate solutions, and in that spirit, one possible solution is being suggested. Market Infrastructure Intermediaries (MIIs) have a provision for the appointment of Public Interest Directors (PIDs). Instead of trying to define independence, and to unsuccessfully ensure it through regulation, would it be preferable to have a PID on the Board of each company where the bona fides of the majority shareholders are in doubt, much like the banking Regulator had its representatives appointed on the Boards of some banks which were on the regulatory radar.

Yet another solution would be to categorise IDs as Non-Promoter Directors, and pray that their good conscience will persuade them to act independently. As Alfred Tennyson famously observed “More things are wrought by prayer than this world dreams of”.

Do let us know of any specific issues you would like to see addressed in subsequent issues.

Excellence Enablers

Corporate Governance Specialists | Adding value, not ticking boxes | www.excellenceenablers.com

(292KB)

(292KB)